Far-reaching influence of Russia-Ukraine war on global textile and apparel industry

Source: chinatexnet Date: 2022-03-21

The Russia and Ukraine war has started for more than 10 days, and there are no signs of a ceasefire agreement between the two sides in short term. Its influence on global cotton textile industrial chain is gradually expanding.

1. Influence on global textile and apparel trade flow

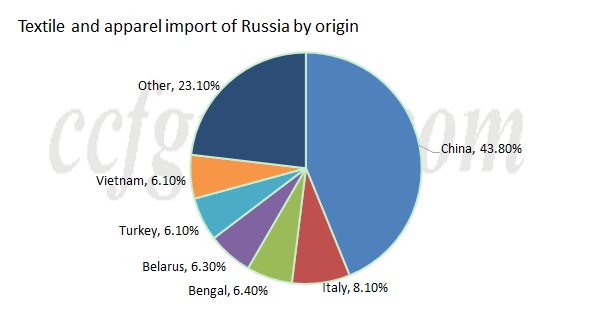

Among the major import origins of textile and apparel in Russia, the proportion from China takes a high of 43.8%, following Italy 8.1%, Bangladesh 6.4%, Republic of Belarus 6.3%, Turkey 6.1% and Vietnam 6.1%.

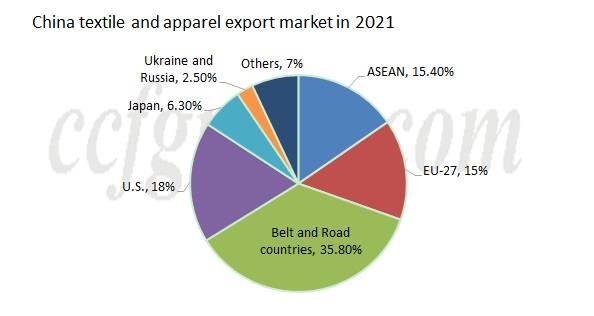

Viewed from the China and Russia relations and global trade change, the market shares of China in Russian textile and apparel imports may increase further in long run, to fulfill the supply gap caused by the sanctions from Europe and U.S. For China, the textile and apparel exports to Russia take a very small proportion, easy to meet the new demand from Russia. However, restrained by the large export shares of EU, Japan and U.S. for China, if the war influences the relations between EU, Japan, U.S. and China, China’s textile and apparel exports may face obvious pressure.

Since Italy is a member of the EU and NATO, the relationship between Russia and the EU and NATO has become tenser after the outbreak of the Russian-Ukrainian war, which will inevitably affect their economic and trade relations.

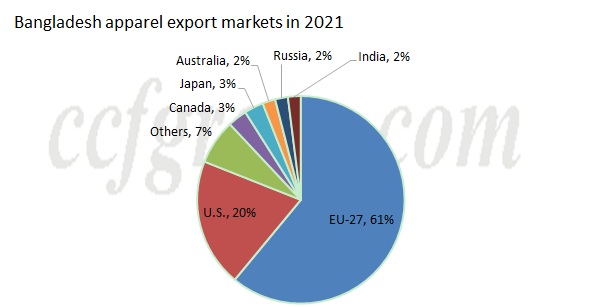

For Bangladesh, its apparel exports to EU and U.S. take a share of 81% in its total export value, while its exports to Russia only account for 2%. If EU and U.S. put pressure on it, Bangladesh may give priority to EU and U.S. over Russia.

In Turkey, it is reported that textile and leather goods manufacturers in Istanbul are feeling the pressure of Russia's invasion of Ukraine. Customers in Moscow and Kyiv canceled $200 million in orders over the past week, industry officials said. Officials estimate there is an immediate risk of more than $1 billion for the textile industry alone if the conflict in Ukraine continues.

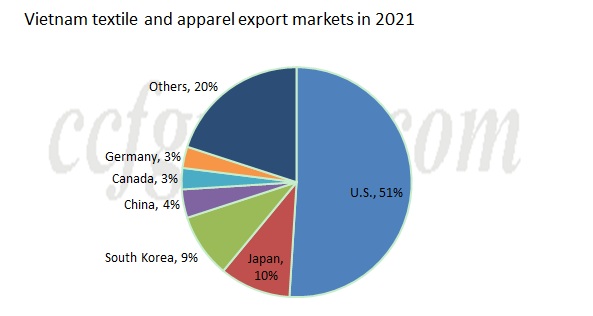

For Vietnam, its textile and apparel exports to U.S. and Japan take a share of 61% in its total exports, while that to Russia are obviously lower. It may have the same action like Bangladesh.

In general, the economic and other sanctions caused by the Russian-Ukrainian war may lead to a decrease in the export of textiles and clothing from several major exporting countries to Russia, and this part of the decrease may be fulfilled by China. However, since Russia's textile and apparel import demand accounts for a relatively small proportion in the world, the Russian-Ukrainian war may more affect global trade flows, while its impact on total demand may be relatively limited.

2. Far-reaching influence on textile and apparel industry

Russia is a large exporter of crude oil and natural gas, and after the outbreak of the war, the prices have surged.

The skyrocketed energy price spur up the global textile and apparel processing costs. Pakistan originally face the supply shortage of natural gas and electricity, and the higher energy price will damage its textile and apparel exports. After the supply interruption of Russia, European countries begin to purchase natural gas from global market. Pakistan faces supply shortage and high prices.

Meanwhile, Russia is also a major exporter of fertilizers. In 2021, the export volume of urea is 7 million tons, accounting for 3.56% of global production. Brazil has begun to seek to import more fertilizers from Canada to make up for the shortage of Brazilian fertilizer imports caused by the conflict between Russia and Ukraine. It is reported that potash fertilizers produced in Canada, Israel, Russia, Belarus and Germany account for 80% of the global share.

Global cotton planting costs are likely to keep increasing with higher prices of fertilizers. Farmers may concern about the both impact of planting benefits and fertilizer shortage. The planting areas in 2022/23 season still have large uncertainties.

In addition, the war has also led to a shortage of seafarers, and the global supply chain may face the risk of disruption. The Seafarer Workforce Report, published in 2021 by BIMCO and ICS, reports that 1.89 million seafarers are currently operating over 74,000 vessels in the global merchant fleet. Of this total workforce, 198,123 (10.5%) of seafarers are Russian and Ukraine accounts for 76,442 (4%) of seafarers. Combined they represent 14.5% of the global workforce. 26,000 seafarers may be lacked in the next four years. International sea freight may keep high for long time.

In short term, the sanctions on Russia may make major textile and apparel exporters reduce the export volumes to Russia, and the decreasing volumes may be fulfilled by China. However, since Russia's textile and apparel import demand accounts for a relatively small proportion in the world, the Russian-Ukrainian war may more affect global trade flows, while its impact on total demand may be relatively limited. For long term, the global energy prices surge, which may cause a higher global cotton planting costs and textile and apparel processing costs. Meanwhile, the insufficient seafarers will be seen continually. From the angle of cotton textile industrial chain, the war is more likely to drive costs higher for a long time.